Empowering girls through early financial literacy education

Why?

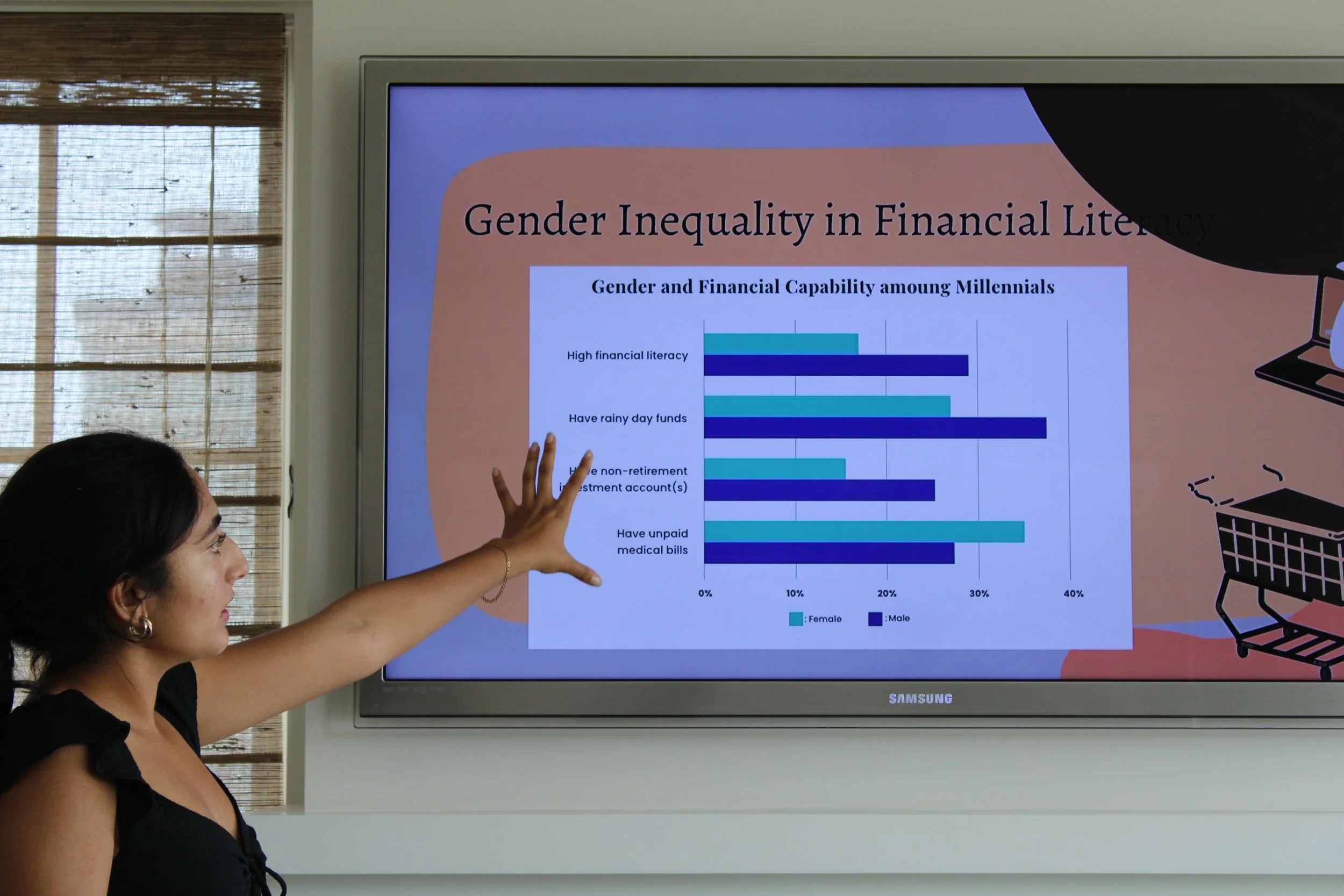

The gender gap in financial literacy is a pressing issue in our society today. Women are less likely to learn about, talk about, and advocate for their financial education. The female brain is especially well-suited to make financial decisions, however, the gender-biased environment girls and boys grow up in makes that very difficult. Studies show that women are more likely to mishandle their accounts, find themselves in heavier debt with 66% of women carrying credit card debt as opposed to 33% of men, as well as be subject to a pay gap. To exacerbate this problem, California is not among the 12 states that currently mandate financial literacy throughout K-12 education and it does not seem like that is in cards for California legislators. Girls are set up for failure in our society and economy however this is an easily solved issue.

Our Method

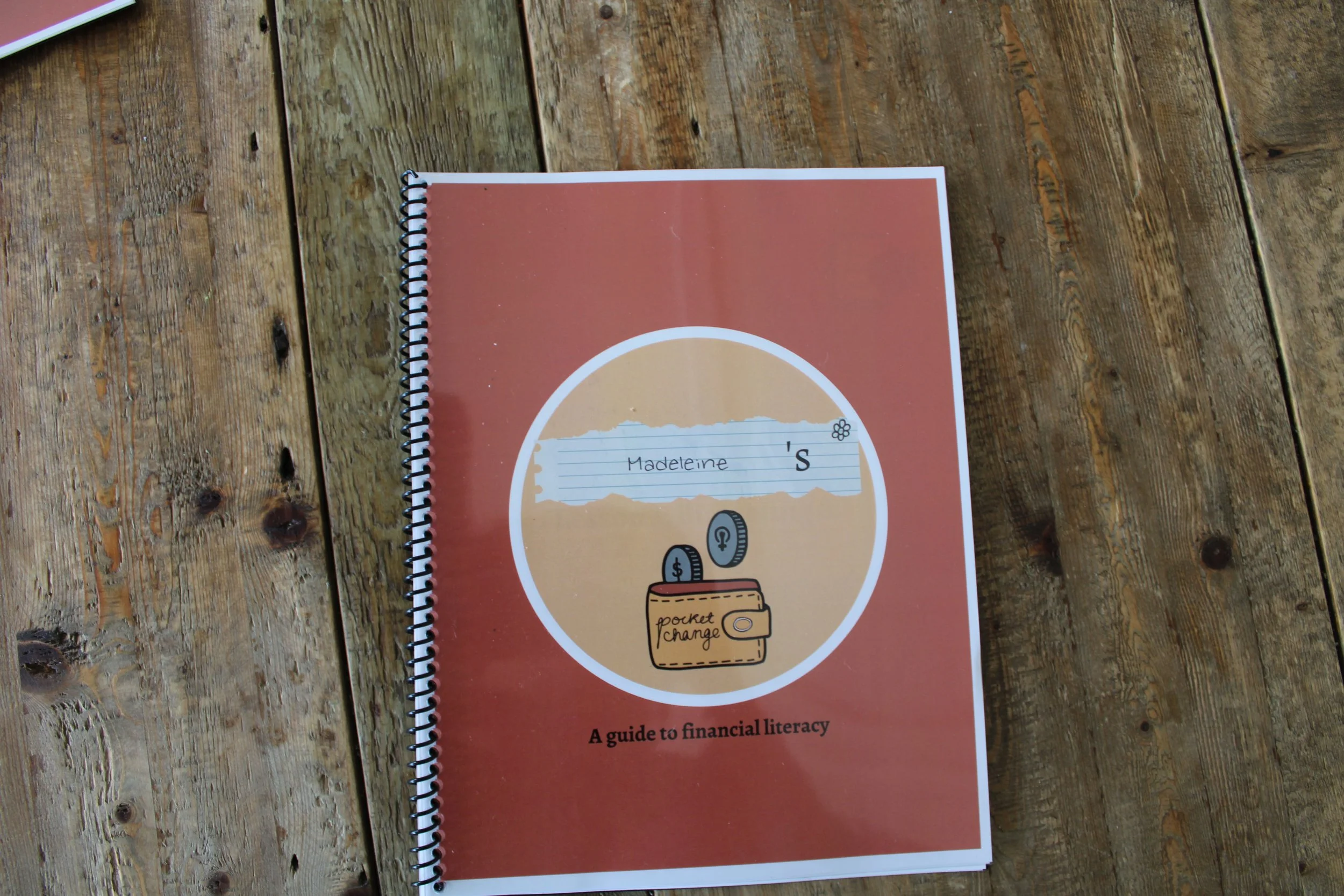

Pocket Change aims to address this disparity through an early intervention education program with a financial literacy curriculum specifically tailored to the female brain - breaking the pattern of education resources being targeted towards men. Pocket Change implements “experiential learning” or project-based education to teach financial skills to girls. Encouraging students to operate within real-life scenarios is a proven successful method for female retention of material.

Community Workshops

In August 2022, we hosted the first Pocket Change proof of concept workshop with a group of 6th-grade girls in the Los Angeles community. We gave them printed and bound booklets that contained a lesson on budgeting and saving, paired with an engaging teaching presentation. The workshop was successful and a wonderful foundation to build Pocket Change.

Contact

Feel free to contact us with any questions.

Email

edesai06@gmail.com